- Home

- Personal Banking

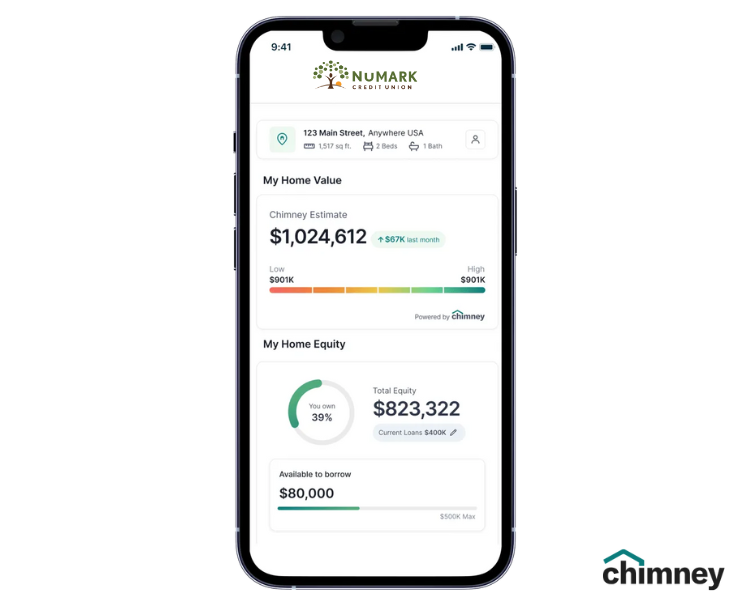

- Digital Banking

- Online & Mobile Banking

Online & Mobile Banking

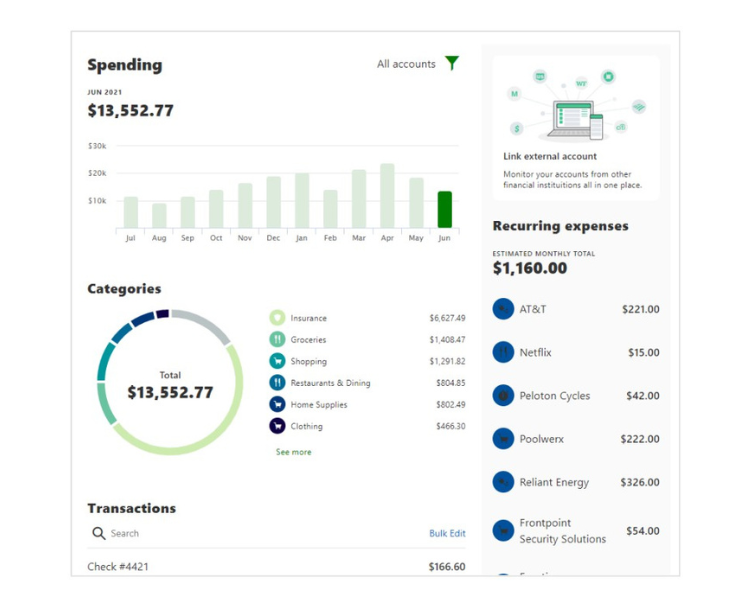

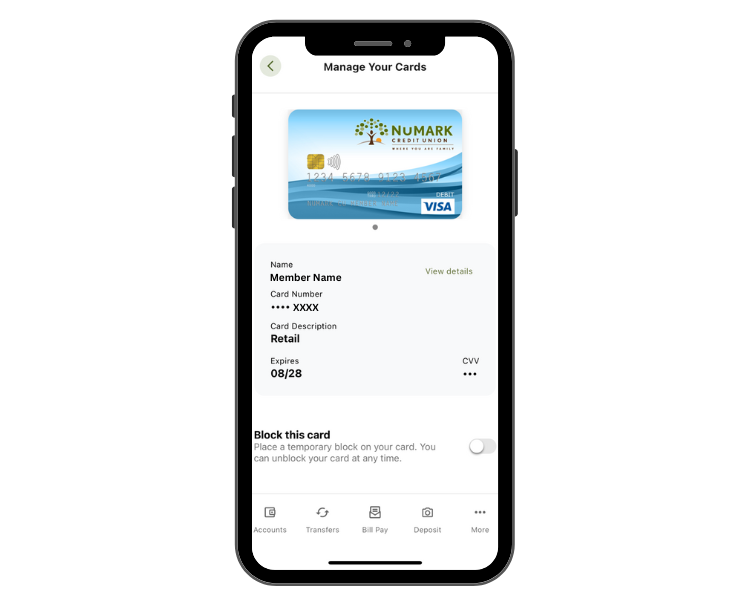

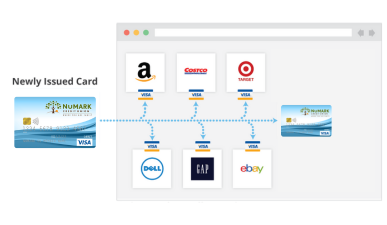

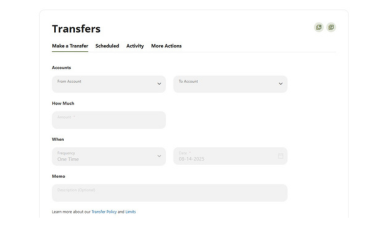

Banking Made Easier

Our state-of-the-art online and mobile banking platforms have been carefully designed with you in mind. Enjoy a personalized experience that makes self-servicing your NuMark accounts from your preferred device easier than ever!

Become A MemberRegister NowOnline Banking Login