Account Alerts

At NuMark Credit Union, we want to help you stay connected to your money through online and mobile banking. Setting up account alerts is one of the best ways to monitor your balances, keep track of your spending as well as set up payment reminders.

The e-alerts that you currently have set up with your NuMark accounts will be discontinued on April 28th, 2022. Please take a few minutes to set up new e-alerts on either our Mobile or Online Banking platforms.

There are two types of alerts that are replacing our Legacy Alerts:

- Real-time alerts through Debit Card Controls.

- Daily alerts for account balances and payment reminders.

Our Real-time and Daily alerts give you more options for monitoring your accounts and will only take a few minutes to set up on either our Mobile or Online Banking platforms.

Mobile Banking Alerts

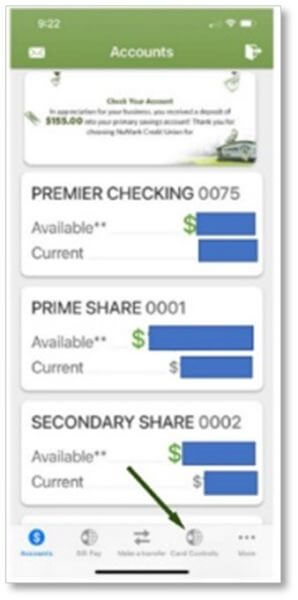

Debit Card Alerts are available through our Debit Card Controls located on the Mobile App. Select Card Controls. Then, click on the Set Declines and Alerts button. From there you will have the option to set up alerts for different types of transactions or spending amounts. With Card Controls, you receive real-time alerts, so you can see transactions on your account as they happen. You have the ability to receive text messages, push notifications, emails, or a combination of all three.

To set up low balance alerts, deposit alerts, and loan payment notifications, click on the More Menu option at the bottom of the main screen. Then, select the Settings icon which looks like a gear on the top right-hand side of the screen. From there, click on Push Notifications. You will see all of your accounts. You have the ability to set up individual account alerts as well as loan payment reminders. These alerts are sent daily to the options you choose.

Online Banking Alerts

If you prefer to set up alerts through Online Banking, you can set up daily alerts for balances and payment reminders, by selecting Additional Services → Text Banking & Alerts. You will see an option for adding or updating your email address and mobile number for alerts. On this screen, you will see the alerts that have already been set up.

If you wish to add an alert, click on Add an alert on the top right-hand side of the screen, you will see all of the alert options listed.

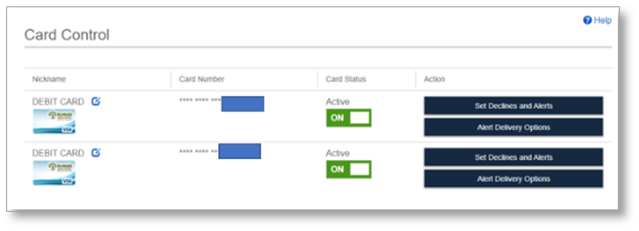

To set up real-time Card Control alerts, select Additional Services → Card Controls. You will see your debit cards listed. Select Declines and Alerts to manage the alerts for each card. From there you will have the option to set up alerts for different types of transactions or spending amounts. Click on Alert Delivery Options to choose your alert preferences. You have the ability to receive text messages, push notifications, emails, or a combination of all three.

As you can see, the alerts on either the Online or Mobile banking platforms give you the ability to keep track of your transactions, balances, and loan payments.

If you have questions about setting up e-alerts for your accounts, please call us at 815-729-3211. We will be happy to assist you.